![]()

Consumers and Businesses

Furniture Financing

We are excited to offer flexible furniture financing options for both individual consumers

and businesses through our partnerships with Klarna and Mondu.

Enhance your space with ease

Discover Easy Furniture Financing with Klarna for Home and Mondu for Business.

What is Klarna?

With Klarna, enjoy shopping at your preferred stores and pay later by splitting your purchase into interest-free, monthly manageable installments.

How does it work?

Step 1 Add products to your cart and select “Klarna” when you checkout

Step 2 Enter a few personal details and you’ll know instantly if you’re approved

Step 3 Klarna will send you an email confirmation and reminders when it’s time to pay and you can manage your orders and payments in the Klarna app.

Payment Options

Based on your country and the transaction amount, Klarna offers various payment options. With each option, Klarna immediately pays for the items in full and later collects the amount from you. The options offered to you as customer include:

- Installments: Pay for the purchase in 3 or 4 fee- and interest-free installments.

- Pay later: Pay for the purchase in 14, 21, or 30 days.

- Financing: Spread the cost of a purchase over multiple months. This option usually involves interest and a credit check.

- Pay now: Pay for the purchase immediately by direct debit, card, or bank transfer.

| Customer's country | Currency | Instalment | Pay Later | Financing | Pay Now |

|---|---|---|---|---|---|

| Netherlands | EUR | 14 days | |||

| Germany | EUR | 14 days | |||

| France | EUR | Pay in 3 | |||

| Ireland | EUR | Pay in 3 | |||

| Austria | EUR | 14 days | |||

| Belgium | EUR | 21 days |

Pay in 30 days

Make your purchase today so you can try before you buy.

Only pay for what you keep. Pay up to 30 days later. No interest. No fees. No impact to your credit score.

Paying after delivery allows you to try before you buy and is the easiest way to shop online.

- Complete the payment in full after purchase at no added cost.

- Report returns directly in our app and only pay for the items that you keep.

- Not making your payment on time could affect your ability to use Klarna in the future.

- Debt collection agencies are used as a last resort You must be 18+ .

Pay in 3 interest-free instalments

Spread the cost of your purchase into 3 interest-free instalments.

The first payment is made at point of purchase, with remaining instalments scheduled automatically every 30 days.

No interest or fees. Select the Klarna option and enter your debit or credit card information.

To check your eligibility, Klarna will perform a soft search with a credit reference agency. This will not affect your credit score. No interest.

No fees. No impact to your credit score.

- A new way to pay that's an alternative to a credit card.

- 3 instalments gives you flexibility to shop without interest or hidden fees.

- Not making your payment on time could affect your ability to use Klarna in the future.

- Debt collection agencies are used as a last resort. You must be 18+.

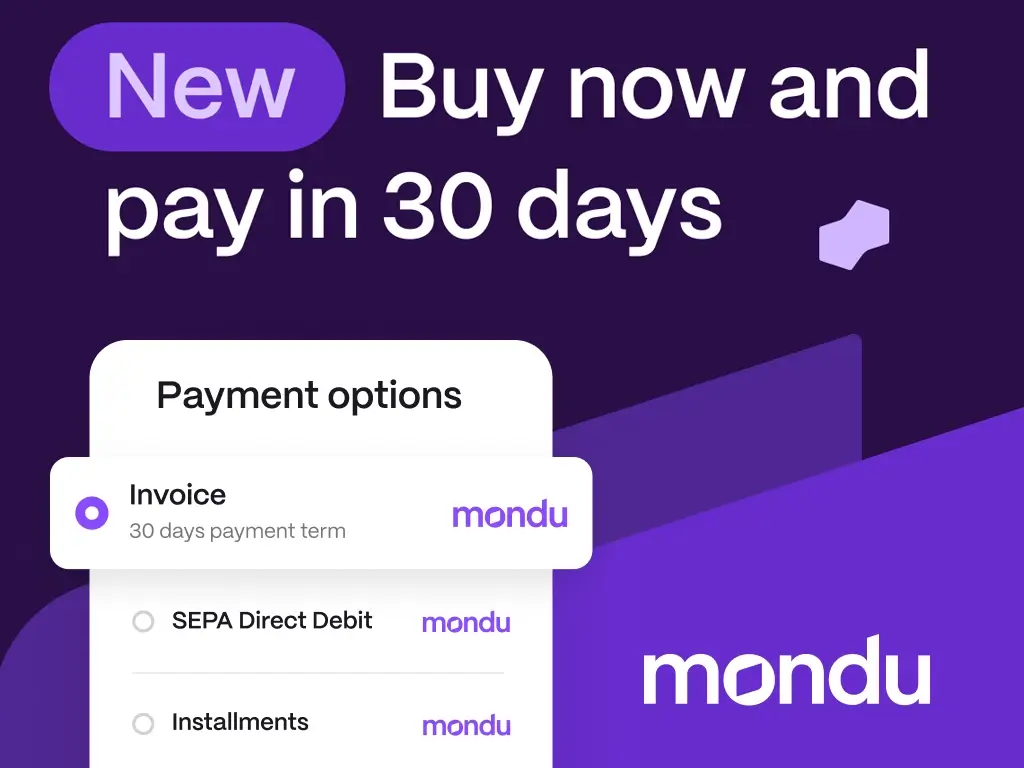

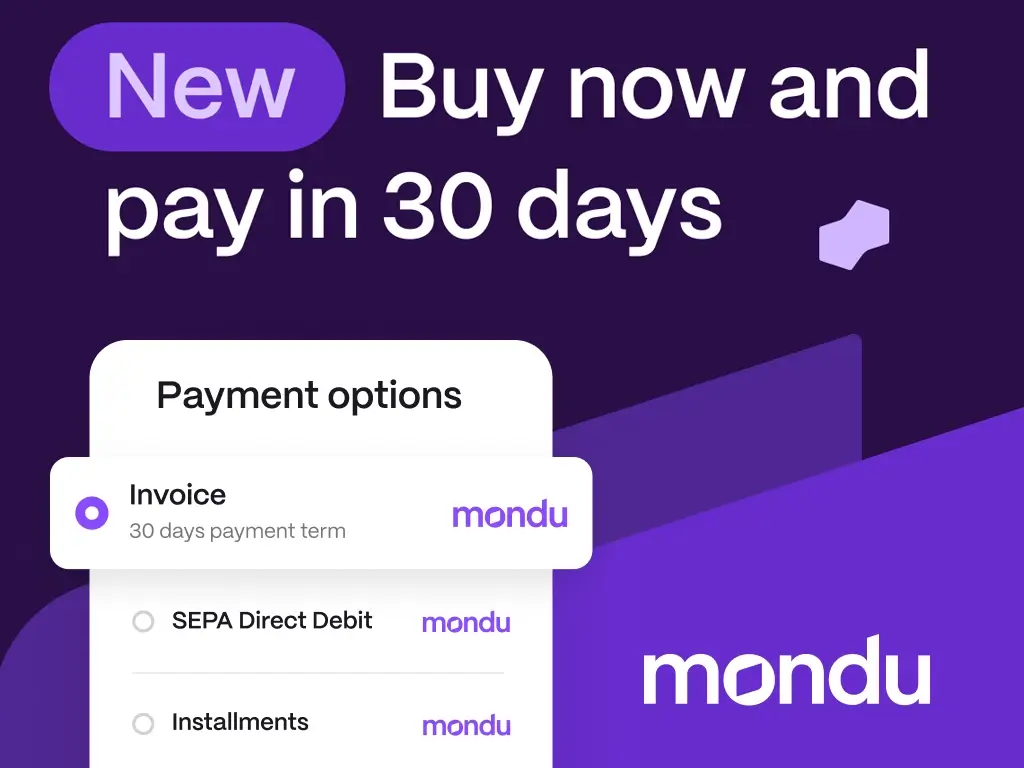

What is Mondu?

Mondu allows business buyers to "Pay by Invoice". Once the business information is filled in, a payment term is assigned based on the risk assessment, allowing you to Buy Now and Pay Later.

How does it work?

Step 1 You select Pay by Invoice at checkout;

Step 2 Fill out your business details;

Step 3 Once the risk assessment is complete, proceed to place the order;

Step 4 Pay the invoice in 7-90 days, through your preferred payment method - iDeal (Netherlands), SEPA DD (Euro Zone) or bank transfer.

Pay by Invoice (Businesses only)

We understand that flexibility in payment options is important to our wholesale clients.

For our B2B clients, we have partnered with Mondu to offer a pay after delivery option. Mondu is a third-party payment provider that allows businesses to pay for their purchases after they receive the goods.

What payment terms do I have?

With Mondu, wholesale customers can make purchases at Furnicher and have the flexibility to pay 7/15/30/45/60/90 days after their purchase based on the credit assessment of your business.

What countries does Mondu cover?

Mondu is industry agnostic and works with merchants and buyers across Europe.

During checkout:

If you select the ‘Pay by invoice with Mondu' payment method during checkout, Mondu will ask for information about your company. Mondu then performs real-time analysis to assess your eligible credit limit.

What if I can’t find my company in the list of companies?

In cases you cannot find your information in the local business registry, you can manually provide your business details (business name, country, registration number, and address).

Why do I need to send my information to Mondu before payment?

In order for you to use this payment method, Mondu needs to approve your company first and make sure that there is no fraudulent history. This way they can assess your credit risk and ensure that you will be able to later pay the invoice without issues. Without validating your business details first, Mondu cannot give you a credit limit.

How long does it take to assess the fraud- and credit risk?

Almost instantly! Mondu will complete an online review of the provided details and notify you almost instantly of the result. In certain cases, Mondu needs more time to complete the review. In the case of a manual review, we will notify you online. A manual review can take up to 1 business day.

What happens during the manual review?

Usually, manual reviews are done within a few hours and a maximum of 1 business day. Keep in mind that until the manual review is done, the order will not be accepted.

Can I consider my order accepted before the review process finishes?

If you don’t have time to wait for the review process to end, you always have the option to pay directly for your order. If you choose to pay directly, you don’t have to pay to Mondu anymore once the review is finalised, as you have already paid.

Why was I rejected?

There are a few reasons why someone might be rejected for "Pay later by Invoice," such as suspected fraud, a low credit score, a high chance of late payments, discrepancies in provided information compared to what Mondu finds from registries or credit bureaus, or ongoing legal issues. If you disagree with the decision or need a higher credit limit, feel free to reach out to us. We can request Mondu to reassess your case. For a different decision, Mondu might require additional information about your payment history with us or your financial situation.

After approval:

After approval, you will be assigned a credit limit that you can use for your purchases. Once your company is approved, we can start with the process of your order, and the order amount is deducted from their credit limit.

What is the credit limit and how does it work?

When Mondu approves a customer, they receive a credit limit, which acts as a spending limit. Customers can use this limit for multiple purchases as long as they stay within its bounds. As customers pay their invoices on time, their credit limit increases.

What if I want to request a higher credit limit?

If you would like to request a higher credit limit, feel free to reach out to us. We can request Mondu to reassess your case. For a different decision, Mondu might require additional information about your payment history with us or your financial situation.

How to pay back to Mondu:

Once your order is placed, you will receive an email from Mondu with payment details. When the invoice is due, you should pay Mondu directly. You can pay your invoice through bank transfer, SEPA Direct Debit, or iDeal. You can find these payment methods through the emails you get from Mondu, just by clicking on the "Pay Online" button in Mondu’s emails. Alternatively in the emails you can find Mondu’s bank details.

What happens if I pay late?

If you haven't paid as per your due date, kindly note that this means you will receive reminders from Mondu. This can be through, but not limited to, emails, phone calls, sms, whatsapp, until your invoice is paid. In the case we cannot establish contact with you and the invoice remains unpaid, we may forward you to a collections agency. In case of disputes please make sure you contact us as soon as possible, ideally before the invoice is overdue.

I have already paid, but I still received a payment reminder. What should I do?

Please consider 1-2 business days for payments to be processed, however should you have made payment before this, then kindly contact payments@Mondu.com with your payment confirmation and Mondu will review your payments for your purchases.

I do not agree with my invoice, what should I do?

If you disagree with your invoice, you should contact us at contact@furnicher.com as soon as possible, ideally before your invoice passes the due date. Our customer service team will be able to help you make the necessary changes to the invoice.

Where do I get a copy of my invoice?

You receive emails with your invoice attached from us, and otherwise please contact payments@mondu.com, and we will re-send your invoice to you.

I have already paid, but still receive payment reminders. What should I do?

Please contact us at payments@mondu.com and advise your invoice number and payment date, we can then review your account and will provide you with feedback on why you are receiving reminders.

9400+ TRUSTPILOT REVIEWS

9400+ TRUSTPILOT REVIEWS

EN

EN DE

DE FR

FR NL

NL DK

DK SE

SE